Navigating the ESG Disclosure Landscape:

Challenges and Promises for Sustainability Professionals

By Eva Wilson

October 18, 2023

Introduction

In today’s corporate landscape, sustainability professionals are grappling with the intensifying call for transparency regarding their company’s environmental impact. The demand to consider not just financial performance but also the environmental, social, and governance (ESG) aspects of business operations is gaining momentum—momentum that is building and building and building slowly in one direction—towards new regulation.

ESG and Its Importance

ESG, an acronym for Environmental, Social, and Governance, encompasses a comprehensive set of business criteria. This includes evaluating environmental factors, such as a company’s ecological footprint, social considerations, which pertain to its relationships with employees and communities, and governance aspects related to the company’s leadership and decision-making processes. Publicly traded companies often convey their ESG performance by generating scores through platforms like Bloomberg, S&P Dow Jones Indices (S&P DJI), MSCI, or CDP, among others. These scores quantify the extent to which a company’s financial health is exposed to ESG-related risks, such as climate change. Generally, companies that provide more comprehensive ESG information tend to achieve higher scores, thereby demonstrating lower risks. Investors use these scores to gauge a company’s capacity to withstand ESG challenges and ensure long-term viability. For consumers, ESG scores serve as a valuable tool to ensure that their investments align with companies sharing their values. For example, as an environmentalist, I may choose to invest more money in a stock that boasts an AAA rating on emissions reductions efforts.

While the increase in ESG disclosures aligns with our global climate objectives, such as those outlined in the 2015 Paris Agreement, the path to disclosure is still nascent, and oftentimes nebulous for the sustainability professionals responsible for implementing these changes.

The Challenge of ESG Disclosure

One of the primary reasons for this uncertainty is the historical lack of mandatory ESG disclosure requirements. Companies are largely left to their own discretion when presenting information about their performance, with the freedom to select voluntary disclosure frameworks that suit their preferences. These decisions are often influenced by investor expectations. As a result, we’ve witnessed what can aptly be described as “the wild west” of ESG reporting.

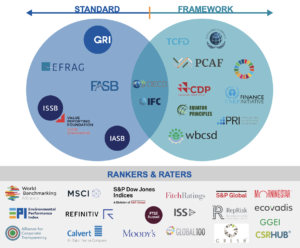

That is, companies have taken a multitude of approaches to share their information, making use of platforms such as websites, regulatory filings, proxy statements, and even blogs. The variation in approaches is substantial, with companies like Google boasting of neutralizing their entire climate footprint dating back to 1998, while Apple uses viral videos to declare their goal of carbon neutrality by 2030. Many companies opt to consolidate this information in an annual Sustainability Report on their websites. These reports frequently comprise an extensive list of commitments, embracing various reporting frameworks like GRI, SASB, TCFD, SBTi, SDGs, GHG Protocol. These frameworks help companies determine what to report in the absence of regulation and what to measure. But again, it is up to the company to decide which framework suits their style.

ESG standards, frameworks, and everything in between

At its worst, the absence of mandated guidelines has led some companies to forgo reporting altogether, a phenomenon known as “greenhushing.” This involves deliberately downplaying ESG claims to evade negative attention. A recent study by South Pole revealed that one in four businesses (25%) do not plan to publicize their science-based targets, effectively escaping scrutiny from stakeholders. Companies may also shy away from setting public targets due to fears of greenwashing, where they make exaggerated claims about their environmental performance. The absence of mandated disclosure requirements has, in some cases, facilitated such practices.

The shared goal of decarbonization – a goal we cannot afford to miss – should eclipse individual concerns for reputation and risk. Fortunately for the sustainability landscape, there are promising signs of progress, albeit gradual.

Promising Regulatory Developments

In October, California legislators took a significant step by passing the Climate Corporate Data Accountability Act (Senate Bill 253). This pioneering legislation mandates that corporations in the state with annual gross revenues exceeding $1 billion publicly disclose their greenhouse gas emissions. This act is the first of its kind in the United States in that it aims to prevent corporate greenwashing by ensuring transparency in a company’s efforts to mitigate climate impact. By 2025, the California Air Resources Board will adopt regulations enforcing these disclosure requirements, affecting an estimated 5,400 companies, including major players like Walmart, Apple, ExxonMobil, and Chevron.

Beyond California, several federal regulatory initiatives are poised to shape sustainability practices at the national level:

- Security and Exchange Commission (SEC) Proposed Climate Disclosure Rules: This rule, initially proposed in March 2022, will require public companies to disclose material climate risks and greenhouse gas (GHG) emissions data. While it’s anticipated that a final rule will be issued soon, pushback from various sectors, including oil and gas, highlights the ongoing debates surrounding the SEC’s regulatory authority in this domain.

- Federal Acquisition Regulatory (FAR) Council’s Proposed Climate Disclosure Rules: Expected in late 2023 or early 2024, these rules will require US federal contractors to disclose GHG emissions data and establish science-based reduction targets, which will impact any/all businesses vying for government contracts.

- Federal Trade Commission’s Green Guides Updates: The Federal Trade Commission (FTC) is actively seeking feedback to strengthen and clarify its guidelines on green advertising and marketing. While the FTC lacks enforcement powers, these guidelines influence regulatory decisions by setting the standard for identifying unfair or deceptive practices.

Preparing for the Future

We are seeing an increase in regulation at a global scale too. Often, we can look to the EU for insights into future regulations that may affect companies operating in the United States. For example, as recently as June 2023, the new EU Deforestation Regulation (EUDR) requires companies importing/exporting certain commodities to/from the EU to demonstrate deforestation-free sourcing or else risk substantial fines. The EU is also hoping to pass the EU Green Claims Directive and the EU Green Transition Directive in May 2024 — regulations that would combat greenwashing by establishing new minimum standards for how companies substantiate, communicate, and verify their environmental claims to consumers in the EU.

The introduction of new regulations may present hurdles for companies striving to meet evolving sustainability standards. The increased disclosure requirements demand more robust data collection and reporting processes, and the heightened scrutiny of sustainability claims means that businesses must ensure their environmental claims are backed by solid evidence, avoiding the risk of being labeled as greenwashers. Staying informed, proactively preparing for compliance, and consistently verifying sustainability claims will be essential for success in the ever-shifting landscape of sustainability regulations. Sustainability professionals certainly have their work cut out for them, but it’s in service to a transparent, accountable approach to decarbonizing our economy.

So, what can you do to prepare? Continue to build out your sustainability capabilities. Identify your key stakeholders. Determine what issues are most material to your business. Collect data with rigor. Watch industry leaders. Participate in pre-competitive groups. Most importantly, keep up with changing regulations and frameworks so that you can be confident in your sustainability roadmap. We are headed in a promising direction, one that aligns with our shared environmental goals and the urgent need to address climate change — and it’s time to pull up our collective bootstraps.

Disclaimer: The information provided here is intended for general informational purposes only and should not be construed as legal advice. While we strive to offer accurate and up-to-date information, the legal landscape can vary greatly by jurisdiction and change over time. Any reliance on the content provided should be exercised with caution, and we recommend seeking the counsel of a qualified attorney or legal professional for specific legal advice tailored to your individual circumstances.